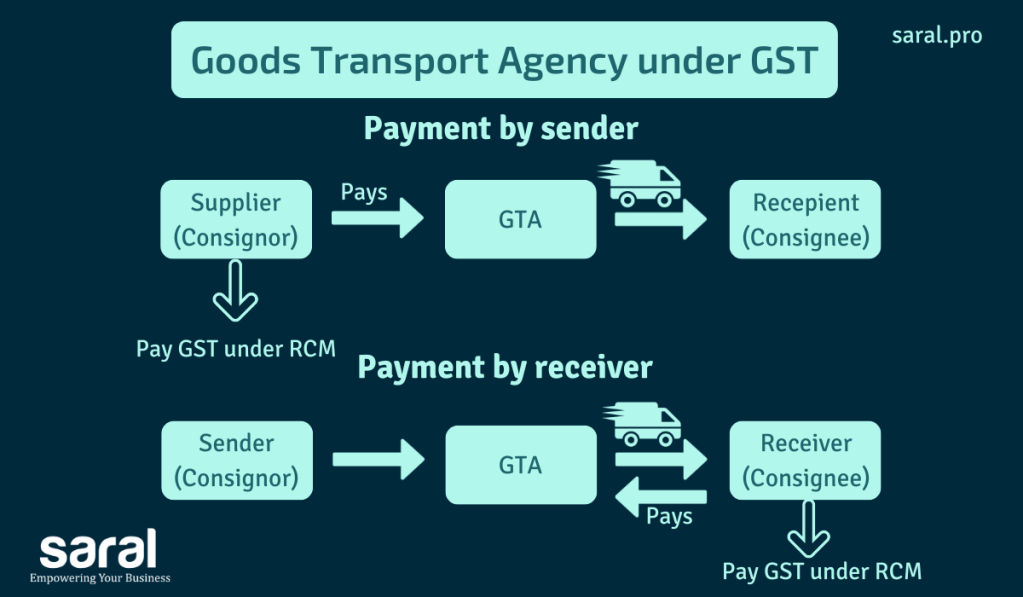

Person liable to pay GST on GTA Services

The liability to pay GST devolves on the recipients ( under RCM @ 5%) for supply of services by a goods transport agency (GTA)who has not paid integrated tax at the rate of 12%, in respect of transportation of goods by road, if the recipient belong to the following category:

- Factory registered under the Factories Act 1948,

- A Society Registered under the Societies Registration Act, 1860

- A Co-operative society established under any law.

- A Person registered under CGST, IGST or SGST.

- Any body corporate established by or under any law;

- Any partnership firm

- Any casual taxable person.

Post a Comment